Access Your Tools for a Confident Retirement

Please enter a valid email address.

Thanks for subscribing! Please check your email for further instructions.

Something went wrong. Please check your entries and try again.

Retirement Evolutions' MAP tools guide you to reach your goals and unlock your true retirement planning potential.

Retirement Planning Workbooks

Stay informed about what you need to know about Social Security, taxes, investing, insurance and the value of having a trusted advisor.

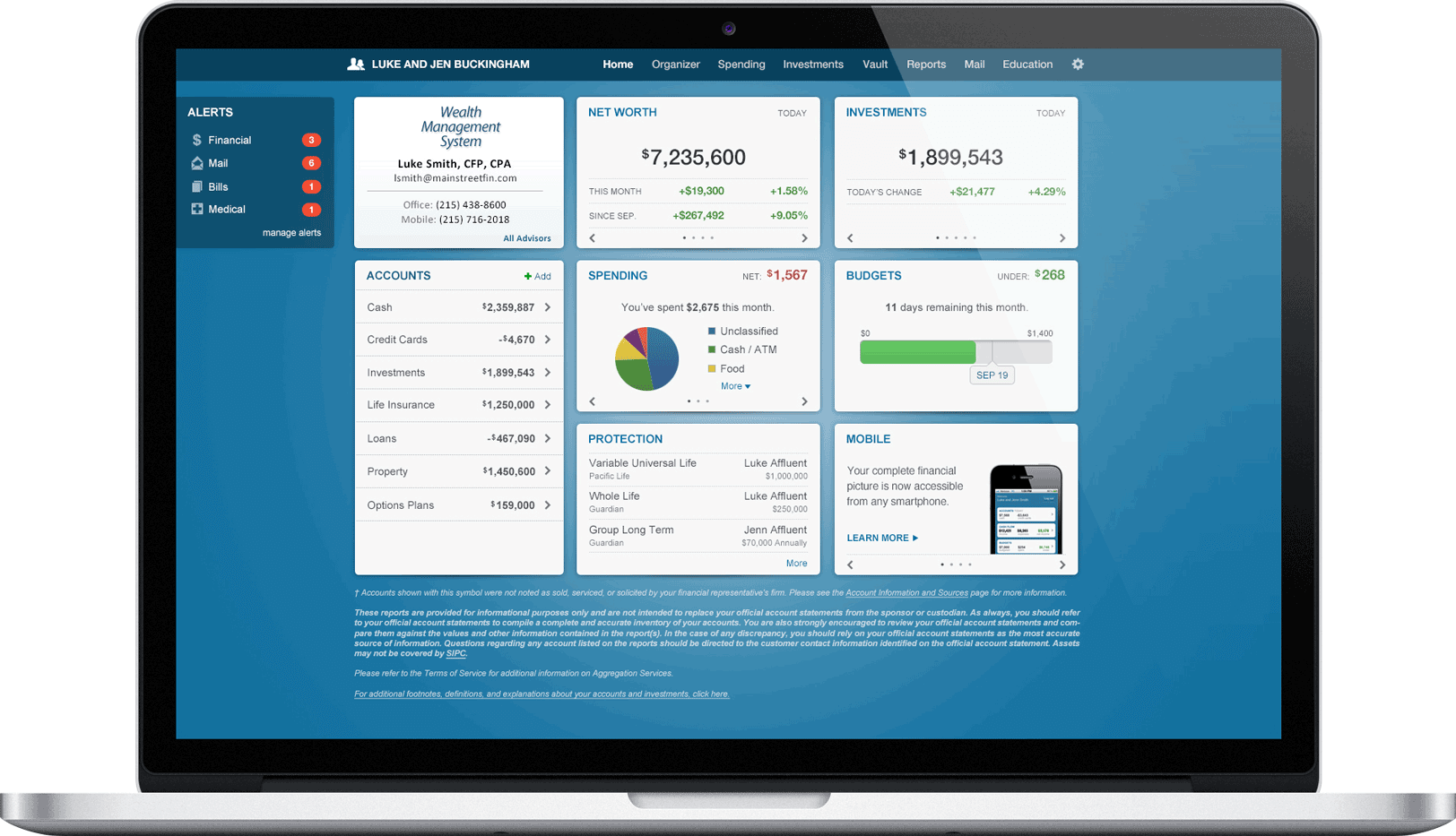

Financial Planning Software

This easy to use free tool provides a secure and easy to use dashboard where you can store all of your account information, set goals, manage your income and expenses and track your progress.

Know Your

Risk Score

Knowing your risk score can help you make appropriate investment choices. Find out your risk score with our RiskAlyze tool!